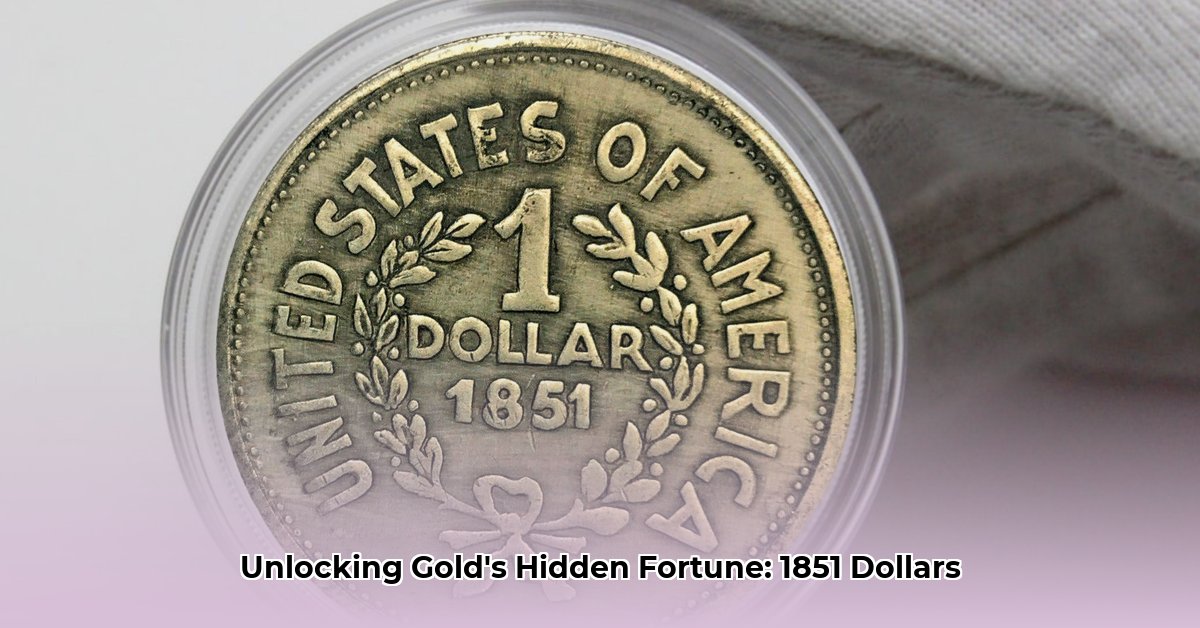

1851 Liberty Head Gold Dollar: A Numismatic Investment Opportunity

Investing in rare coins offers a unique blend of historical significance and potential financial reward. The 1851 Liberty Head Gold Dollar, a small but significant piece of American history, stands out as a compelling investment option. This guide provides a comprehensive overview, equipping you with the knowledge to navigate this specialized market effectively. But first, let's explore the allure of this iconic coin. For more on alternative investments, see this guide on Web3 Investing.

Unearthing the History: Why the 1851 Liberty Head Gold Dollar Matters

Minted during a period of significant westward expansion and economic growth, the 1851 Liberty Head Gold Dollar represents a tangible link to a pivotal era in American history. Its design, featuring the iconic Liberty head, reflects the nation's burgeoning identity and aspirations. However, its investment potential goes beyond historical interest; rarity and market demand play a crucial role in driving its value. The coin’s value is closely tied to its mint mark and condition. Understanding these factors is key to making informed investment decisions.

Identifying and Grading Your 1851 Liberty Head Gold Dollar

Before investing, accurate identification and grading are crucial. Counterfeits exist, and a coin's condition dramatically impacts its price.

Authenticating Your Coin: Spotting the Real Deal

Authenticating an 1851 Liberty Head Gold Dollar necessitates a keen eye for detail. Start by examining the coin's key features: the Liberty head design, lettering clarity, and—most importantly—mint mark variations. The presence and clarity of the mint mark (P for Philadelphia, C for Charlotte, D for Dahlonega, or O for New Orleans) are critical to authentication and significantly affect value. Comparing your coin to high-resolution images from reputable numismatic sources is essential. Discrepancies, however subtle, could indicate a counterfeit. Professional authentication from a reputable grading service is always recommended.

Understanding the Sheldon Grading Scale: Condition and Value

The Sheldon grading scale, a widely accepted standard in numismatics, assesses a coin's condition on a scale from 1 (Poor) to 70 (Mint State). Higher grades reflect better preservation and command significantly higher prices. For example, an 1851-C (Charlotte mint) in Mint State 65 could be worth substantially more than a similar coin graded Very Fine 20 (VF20). Visual comparisons of coins in different grades can offer a helpful benchmark for assessing your own coin's condition.

Market Analysis: Mint Marks, Condition, and Value Fluctuations

The 1851 Liberty Head Gold Dollar's market value isn't uniform; it's highly dependent on two key factors: mint mark and condition.

Mint Mark Rarity and Price: A Significant Influence

The rarity of different mint marks significantly impacts the price. Coins minted in Charlotte (C) and Dahlonega (D) are far rarer than those from Philadelphia (P) or New Orleans (O), leading to substantially higher values for the former. This scarcity is a major driver in the numismatic market, creating a significant price differential between various mint marks, even when coins are in similar condition.

Condition Impact: How Preservation Affects Price

Even within the same mint mark, the coin's condition plays a dominant role in pricing. A coin that's well-preserved and graded highly will fetch a much higher price than one exhibiting significant wear and tear. These variations are significant. A difference of even a few points on the Sheldon grading scale can translate into thousands of dollars in the value of your 1851 Liberty Head Gold Dollar.

Investing in 1851 Liberty Head Gold Dollars: A Step-by-Step Approach

Investing in rare coins like the 1851 Liberty Head Gold Dollar requires a strategic approach.

Authentication and Grading: Begin with professional authentication and grading from a reputable service (e.g., PCGS or NGC) to verify authenticity and determine condition. This step is critical to mitigating risk and accurately assessing value.

Reputable Acquisition: Purchase coins only from established and reputable coin dealers or auction houses with verifiable histories.

Portfolio Diversification: Don't concentrate your investments in a single coin or mint mark. Diversify across different mint marks and conditions to reduce risk.

Long-Term Investment Strategy: Rare coin investing is typically a long-term endeavor. Market fluctuations can happen, but patience is key.

Mitigating Risk: Potential Challenges and Considerations

While the potential returns are significant, investing in rare coins carries inherent risks.

Potential Risks:

Counterfeit Coins: The risk of acquiring a counterfeit coin is real and substantial. Professional authentication is paramount.

Market Volatility: The rare coin market is subject to fluctuations influenced by various economic and market factors.

Liquidity: Selling a rare coin may not always be instantaneous; it can take time to find a buyer at the desired price.

Storage and Security: Proper secure storage is necessary to protect your valuable coin collection.

Risk Mitigation Strategies:

Thorough Due Diligence: Always research your source and the authenticity of the coins before committing to a purchase. Never buy from unknown sellers without expert verification.

Professional Authentication: Professional grading will add verification and reduce risk.

Diversification: Don't concentrate investments.

Legal and Regulatory Compliance: Navigating the Legal Framework

Owning, trading, and selling rare coins, especially internationally, involves legal and regulatory considerations. It’s essential to understand the laws and tax implications in your jurisdiction. Seek legal counsel for advice on tax obligations and compliance, particularly for international transactions. Always ensure your transactions align with both national and international regulations.

Conclusion:

The 1851 Liberty Head Gold Dollar presents a unique investment opportunity. Its historical significance coupled with market dynamics creates a compelling financial proposition. However, success relies heavily on thorough research, professional authentication, informed decision-making, and a well-defined investment strategy. By understanding the factors influencing its value and incorporating appropriate risk mitigation strategies, you can approach this unique market with confidence.